Early Loan Settlement Calculator Uae

The early loan settlement calculator on moneyland ch makes it easy to find how much you still owe for a loan and how much money you could save by settling your debt ahead of schedule.

Early loan settlement calculator uae. The same applies to car loans. 29 2011 regarding bank loans services issued by the central bank of uae states. However if you re taking out a loan to make the purchase searching for the best finance option can really take the edge off the excitement.

Early settlement fee is 1 05 of the finance amount arrangement fee is 1 05 of the loan amount for every aed 1000 of your insurance amount can earn adcb touchpoints documentation is simple high finance amount is offered takaful insurance is provided free with the scheme free adcb credit card is provided along with this scheme credit life insurance is provided along with this scheme. For regulated agreements this is normally an exit fee equal to around just 58 days interest charge. Adcb personal loan min salary 5000 aed onwards interest rate flat 2 61 onwards check eligibility max loan amount 4000000 aed offers 1 05 processing fee apply for personal loan.

You can find an overview of the actual costs of loans from all swiss lenders in the leading unbiased comparison of swiss loans. Calculate settlement this app will calculate the settlement figure of any loan using the actuarial method as required by the early settlement regulations 2004 in the uk. Early settlement from same bank loans is 1 per cent of the remaining balance.

If there is no lock in period you can settle your loan any time you prefer without paying an early settlement fee. Based on the figures entered into the loan early repayment calculator. Appendix no 2 of the regulation no.

This formula assumes all payments are made on time. An early settlement figure is the amount still owed plus interest and charges if you want to pay off your car finance early. Uae car loan calculator buying a new car is super exciting.

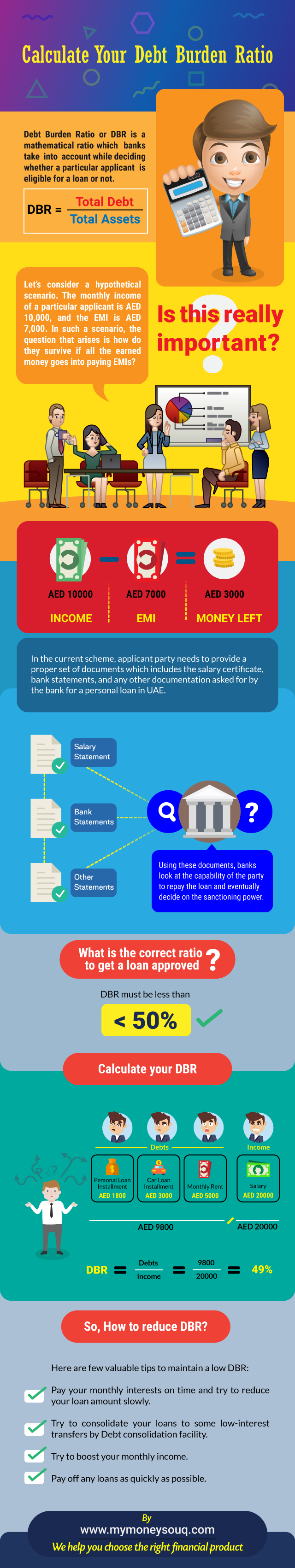

You will reduce the total amount of interest paid on the loan reducing from to which is a saving of in interest payments. If you continue to make monthly payment of you will repay your loan months quicker than if you just paid the standard monthly installment of. That means if you have an outstanding balance of aed 100 000 you will pay aed 1 000 to pay off the loan early.

How is the. Loan early repayment analysis. While some banks do not charge early settlement fees on personal loans others charge one percent the maximum penalty allowed under uae central bank guidelines.