Epf Account 2 Withdrawal For House Installment

2 3 month back have transferred my old epf account to current epf account but problem is that old uan is also live till now and old pension amount showing their now need to withdraw advance pf for house construction but portal not allowing me due to below 60 month current pf account while my old pf service was 7 5 yrs and new pf service is 2 3 yrs.

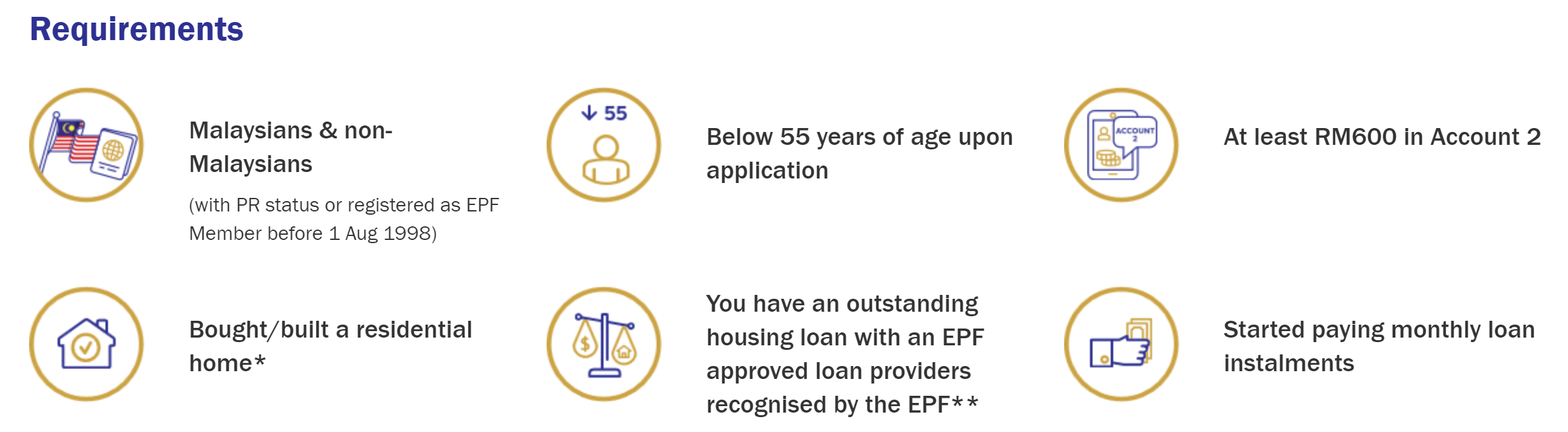

Epf account 2 withdrawal for house installment. You have the option to withdraw epf savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time. Intend to buy 2nd house however cannot take epf to buy 2nd house because first house not yet sold. 300k just example la maybe 100k etc.

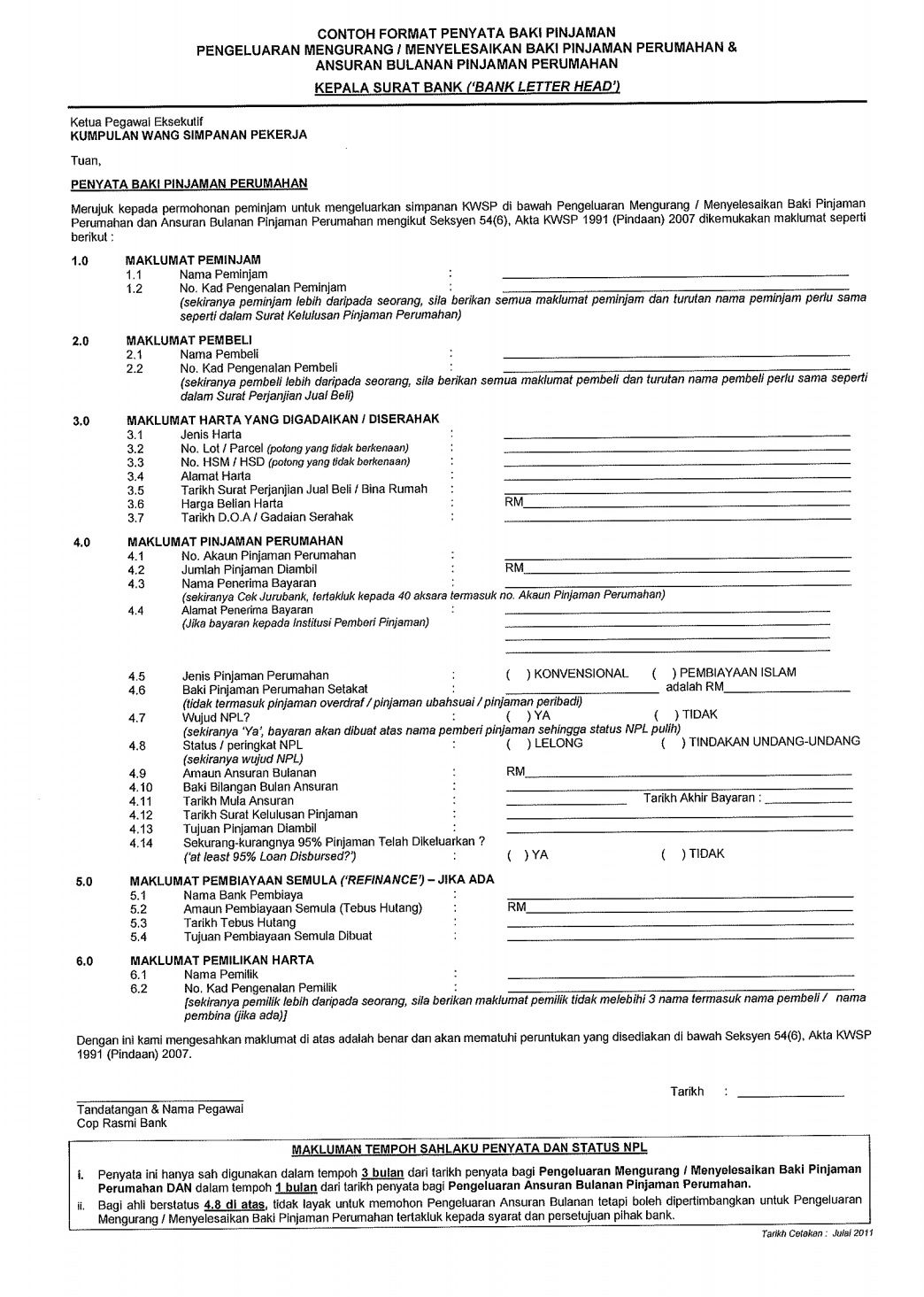

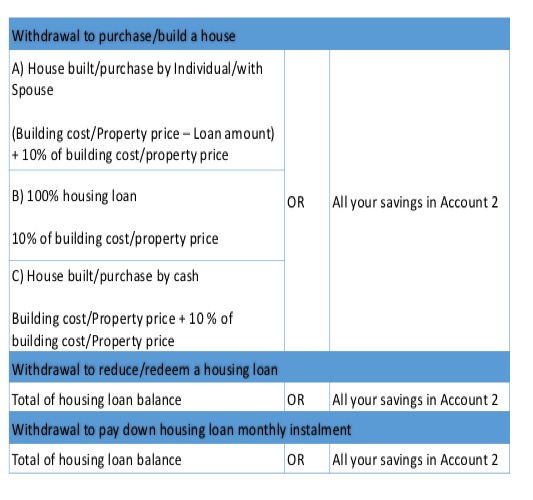

Withdrawal to purchase build a house. Contributors need to go to the epf to apply for the monthly withdrawal only once and subsequent payments would be directly credited to their personal accounts every month. Acc 2 got.

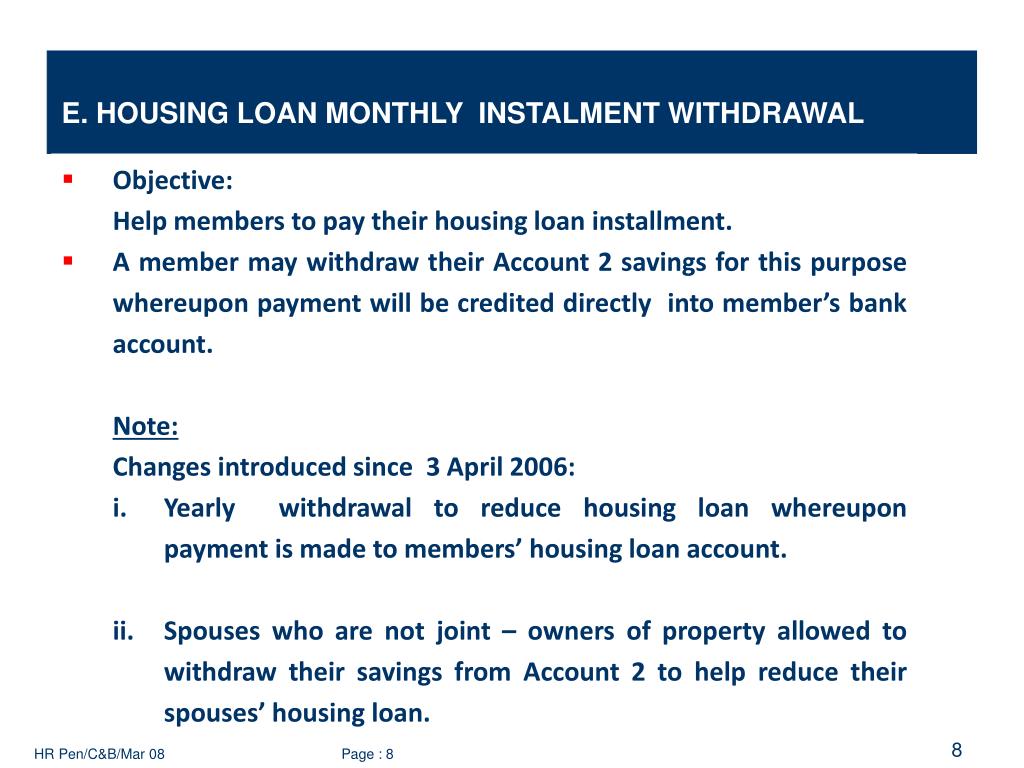

Account 1 is off limits until you reach the age of retirement but you can tap into your funds in account 2 for various investments such as buying a house or paying for a higher education course. There are two options to choose when you withdraw account 2 to service the loan. So that when you find yourself in a tight spot financially you can make a withdrawal from your account 2 to help cover your monthly housing loan instalment for a minimum period of six months or until your financial recovery.

20k 1st house installment left 20k take epf clear it out. Account 1 while the remaining 30 goes to account 2. Quote darkhunter16 oct 2 2017 09 18 pm i plan to withdraw epf acc2 for paying my house monthly installment.

My director got few hundred k on epf 1st house debt already clear 20 years ago. To facilitate epf members in preparing for a comfortable retirement the epf allows you to make a partial or full withdrawal from your savings to meet the specific retirement related needs that are in line with the epf s current policies. Bungalow terrace semi detached apartment condominium studio apartment service apartment townhouse soho or a shop lot with residential unit from a developer individual or in a public auction.

After 20 year age 47 acc 2 got. In an effort to ease the burden of homeowners the epf introduced the housing loan monthly instalment withdrawal. This type of withdrawal involves you withdrawing money from your account 2 to finance your monthly installments for your housing loan which was taken up either to buy a new house or build a new one.

This scheme allows individuals or joint purchasers to withdraw money from their epf account 2 to purchase a house type. A member should obtain 2 housing loan application forms from the nearest labour office or download from the website and send them back duly filled to the same office. You can withdraw from your epf to service a home loan if you re purchasing.

When you reach a certain age the epf allows you to withdraw partially or in full the savings in account 2. May i know what are the supporting documents that i need to.