Epf How Many Percent

If you need more flexible and better payroll calculation such as generating ea form automatically or adding allowance that does not contribute to pcb epf or socso you may want to check out hr my free malaysian payroll and hr software which is absolutely free.

Epf how many percent. Many of the employee and employer s especially new to this field may not be aware of the epf account number contribution rate here in this post we ll discuss the account numbers and usage of these accounts while depositing the epf challan on the unified portal. The epfo will be offering 8 15 per annum and 0 35 will be offered in december. Cpf contribution and allocation rates p cpf contributions are payable at the prevailing cpf contribution rates for your employees who are singapore citizens and singapore permanent residents spr p.

Its purpose is to help employees to save a fraction of salary every month. With this 172 categories of industries establishments out of 177 categories notified were to pay provident fund contribution 10 w e f. Epfo had confirmed earlier that it had settled claims worth rs 94 41 lakh since 1 april 2020.

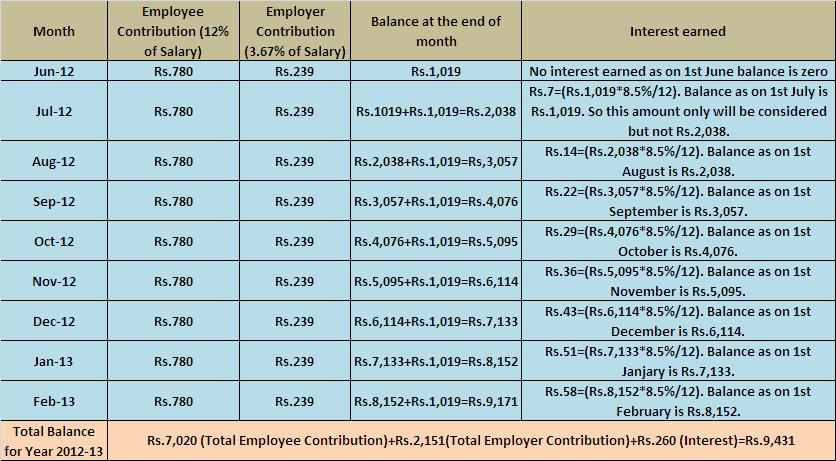

The employees provident fund organisation has decided the interest rate for fy19 20 which will be 8 5 per annum on the provident fund. Employees provident fund epf was established by act no. During this period your employer s epf contribution will remain 12.

Kumpulan wang simpanan pekerja commonly known by the acronym epf malay. Notification dated 9th april 1997 was issued enhancing provident fund contribution rate from 8 33 to 10. The contributions are made to this fund on regular basis.

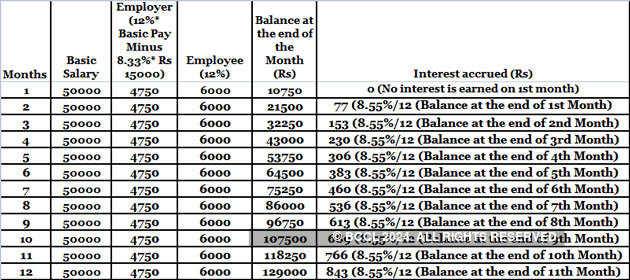

Interest on the employees provident fund is calculated on the contributions made by the employee as well as the employer contributions made by the employee and the employer equals 12 or 10 includes eps and edli of his her basic pay plus dearness allowance da. Hi if you take out your monthly pay slip and check you can understand that every month 12 of your salary is contributed towards epf account. Employees provident fund malay.

Your employer also contr. For sick units or establishments with less than 20 employees the rate is 10 as per employees provident fund organisation s epfo guidelines. 22 09 1997 onwards 10 enhanced rate 12.

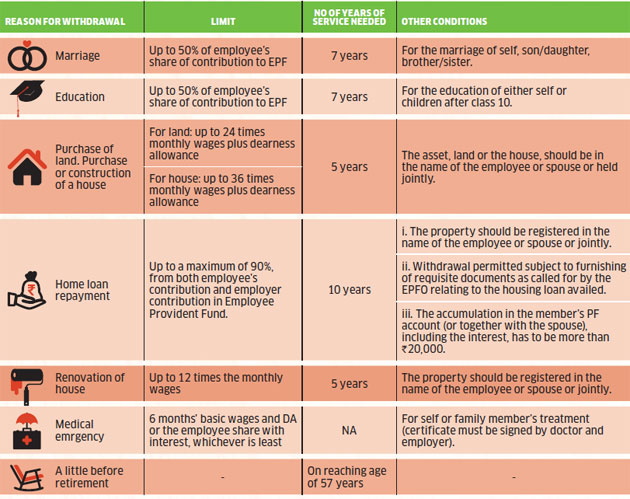

The fund can be used in an event that the employee is no longer fit to work or at retirement. Generally the employee knows that his her 12 is deducting and 12 is paid by his. Btw payroll my pcb calculator 2020 is powered by hr my s payroll calculator.

It manages the compulsory savings plan and retirement planning for private sector workers in malaysia membership of the epf is mandatory for malaysian citizens employed in the private sector and voluntary. Forever for unlimited employees. Cpf contribution and allocation rates.

Also as per budget 2018 the rate of interest applicable on epf is 8 65. Your total monthly contribution is routed towards employees provident fund.