Epf Withdrawal For Housing Loan

You spouse has a housing loan account with a panel bank appointed by the epf.

Epf withdrawal for housing loan. This is the most common form of epf. Epf withdrawal for repay housing loan modifying existing house purchasing sponsored links. For most malaysians there are several types of epf withdrawals to highlight.

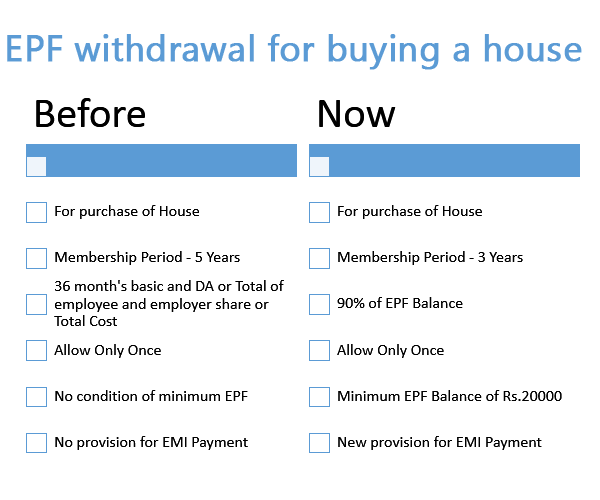

An individual who has a provident fund pf account is allowed to withdraw funds from it against a loan. The employee s provident fund epf scheme allows an individual save towards retirement. The norms to withdraw employees provident fund epf have been relaxed further to enable members of the epfo to withdraw money from their epf accounts to fund the purchase or construction of house.

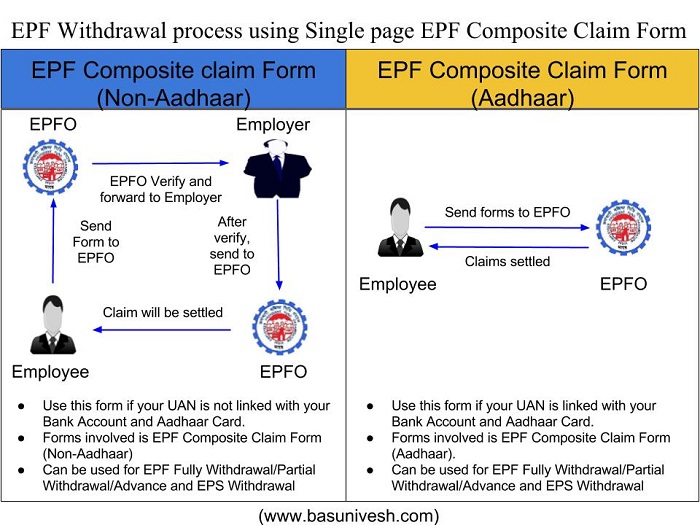

The commissioner issues a certificate specifying the monthly contribution of the last 3 months. However there certain procedures and criteria that one is required to carefully follow. Members with authenticated aadhaar and bank details seeded against their uan can now submit their pf withdrawal settlement transfer claims online.

Follow these simple steps to utilize your epf for repaying your home loan as per the updated epf withdrawal rules a pf member can apply for the loan through the housing society to the epf commissioner in the format prescribed in annexure 1. Min is 8 to 12 epf is 6 for year 2011 around 5 to 6 over past few years. All withdrawal payments will be credited directly into yours or your spouse s housing loan account when you meet the following criteria.

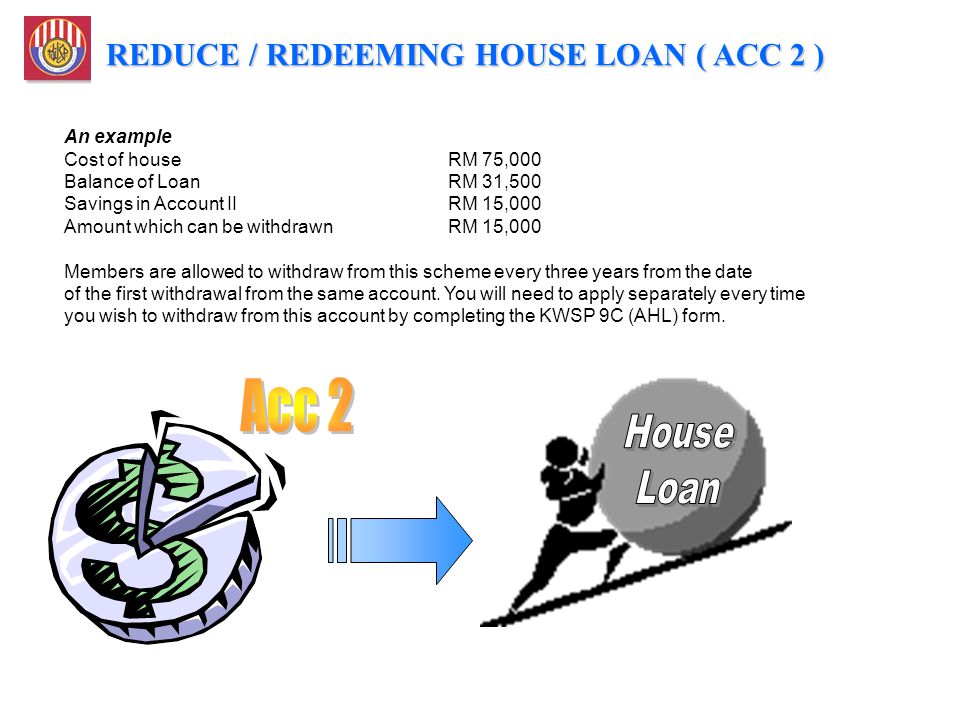

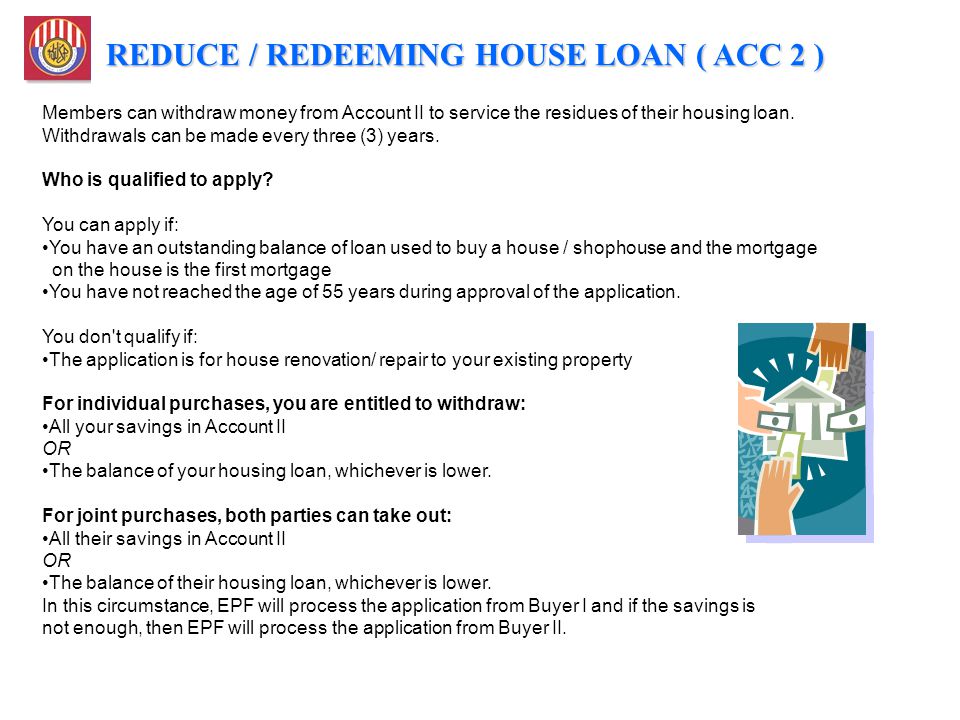

Better withdraw from epf account 2 to housing loan as following points. One can partially withdraw the amount if he she has applied for a loan for. Members can withdraw the existing amount to be used in repaying an already prevailing house loan.

Your spouse s loan with the epf panel bank is not in the non performing loan npl status. A member can view the passbooks of the epf accounts which has been tagged with uan. Process to withdraw the epf amount for repayment of home loan.

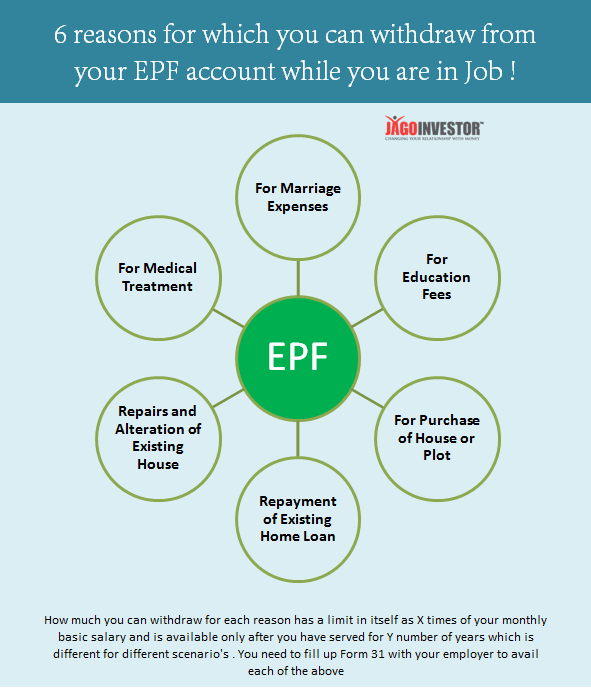

There sure is a lot of reasons the epf allows you to withdraw simply because the situations above regularly requires a large sum of money upfront. Epf allows members to make a partial or full withdrawal from their savings to pay for specific needs under medical housing loans and education.