First Home Buyer Malaysia Stamp Duty

Rm100 001 to rm500 000 rm8000 total stamp duty must pay is rm9 000 00 after first time house buyer stamp duty exemption.

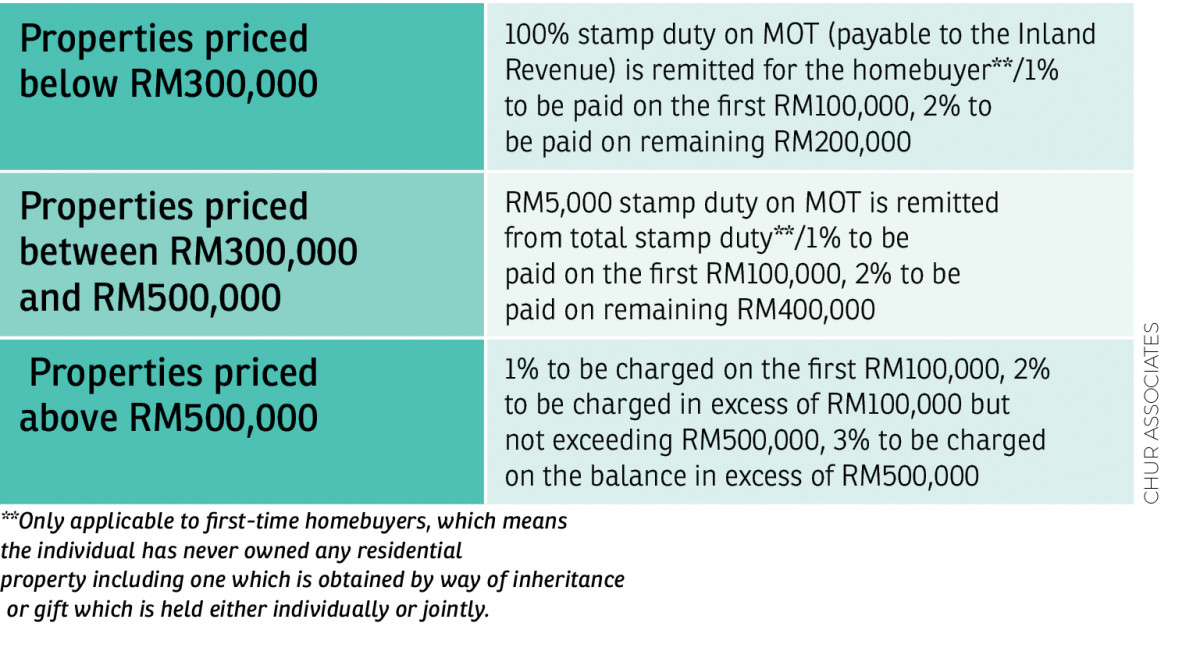

First home buyer malaysia stamp duty. Disbursement fees to be ranging of rm1000 rm1500 00 based on estimation for first time house buyer you can check for the latest. Stamp duty fee 1. For purchases of between rm300 001 and rm500 000 a similar stamp duty waiver is applicable limited to only the first rm300 000 of the house price.

Rm9000 rm5000 rm4000 stamp duty to pay saving amount. However the property developer must offer a 10 discount on selling prices to qualify under the hoc campaign. Pay lower or no stamp duty fees to buy a new property this applies for buyers of properties priced between rm300 000 to rm2 5 million with the fee exemption applicable to the first rm1 million.

And for residential properties priced up to rm500 000. The new stamp duty malaysia 2019 exemption for first time house buyer will be the same as the previous year stamp duty 2018 where for first time home buyers that purchasing residential properties priced up to rm500 000 stamp duty exempted up to rm300 000 on sale and purchase agreements as well as loan agreements for a period of two years until december 2020. First time homebuyers get stamp duty exemption on the memorandum of transfer and loan agreement for property purchases priced no more than rm300 000.

Stamp duty exemption for first home buyers extended 6 months till year end. Professional legal fees to be included 6 of sst. For first rm100 000 rm1000 stamp duty fee 2.

Rm100 001 to rm500 000 stamp duty fee 3. Napic the number of unsold residential properties in malaysia had risen to 32 313 units. The actual calculation of stamp duty is before first time house buyer stamp duty exemption stamp duty fee 1.

First time home buyers in malaysia will be fully exempted from paying stamp duty for properties that cost between rm300 001 and rm1 million us 240 800 the finance ministry. Stamp duty exemption on the instrument of transfer and loan agreement for purchase of first residential home w e f. Book an appointment to get professional property wealth planning view showflat get vvip price direct developer price hardcopy e brochure.

Guaranteed with best price possible. Stamp duty exempted up to rm300 000 until year 2020 starting 2019 first time home buyers purchasing residential properties priced up to rm300 000 stamp duty will be exempted up to rm300 000 on sale and purchase agreements as well as loan agreements for two years until december 2020. Rm500 001 and rm1 000 000 stamp duty fee 4.