First Time Home Buyer Stamp Duty Exemption Malaysia 2019

Stamp duty exemption no 2 order 2019 e o.

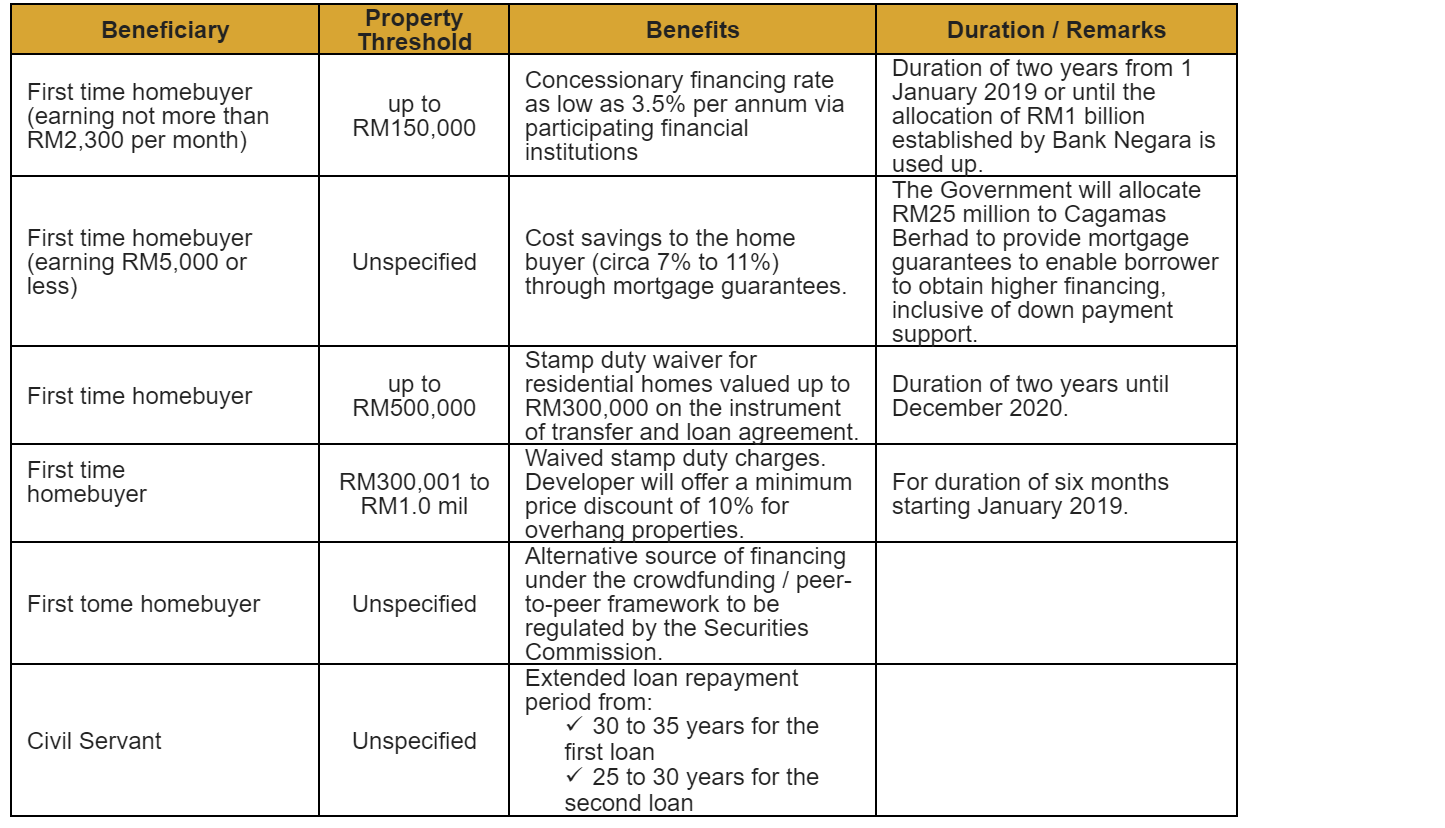

First time home buyer stamp duty exemption malaysia 2019. Stamp act 1949 act 378 budget 2019. Putrajaya as agreed to extend the home ownership campaign hoc for another six months from july 1 2019 until dec 31 2019 the minister of finance lim guan eng announced in a statement today. First time home buyer benefits malaysia 1.

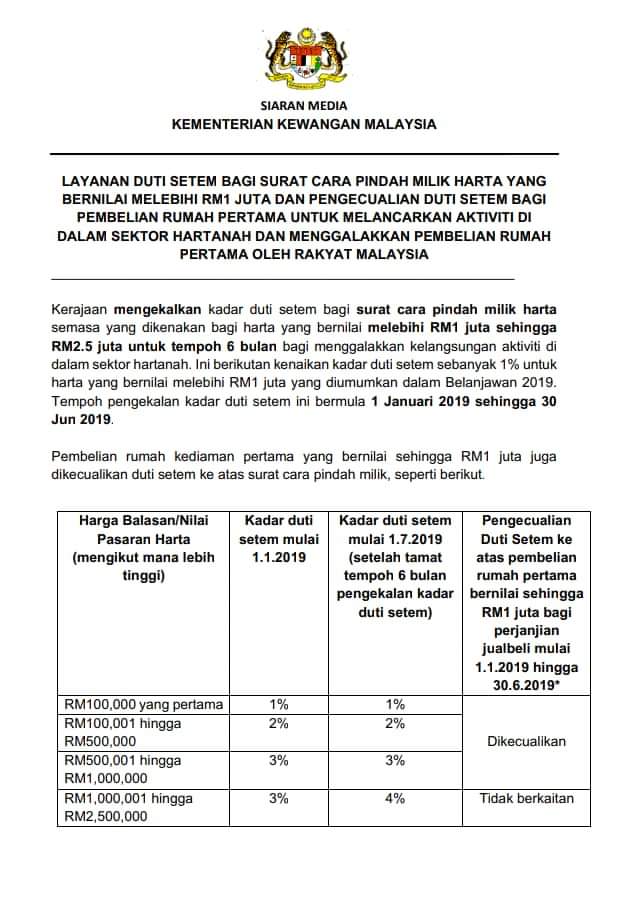

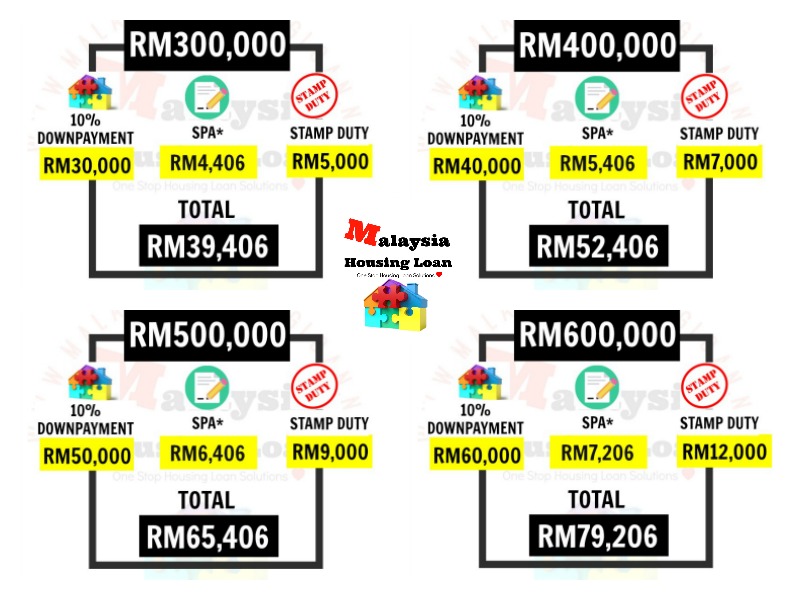

The finance minister had announced during his budget 2019 speech that first time house buyers can enjoy 100 exemption on stamp duty on residential properties if the sales and purchase agreement. Golden period to buy a house in order to address the issue of unsold homes the government has proposed a six month stamp duty exemption for first time buyers of houses priced between rm300 000 to rm1 million effective from january 1 2019 however the property purchase must be with developer only. Previously house buyers had to pay a stamp duty of 1 for the first rm100 000 2 for the subsequent rm100 001 to rm500 000 and 3 for the next rm500 001 to rm1 million.

Good news for first time house buyer. Rm300 001 to rm500 000 purchase price stamp duty exemption only applicable after 1st july 2019. The new stamp duty malaysia 2019 exemption for first time house buyer will be the same as the previous year stamp duty 2018 where for first time home buyers that purchasing residential properties priced up to rm500 000 stamp duty exempted up to rm300 000 on sale and purchase agreements as well as loan agreements for a period of two years until december 2020.

For loan amount. 2 19 exempts from stamp duty any loan agreement to finance the purchase of a residential property under the nhoc 2019 which is valued at more than rm300 000 but not more than rm2 5 million and is executed between an individual and any of the financial institutions listed in sub paragraphs 1 a 1 i of paragraph 2 of e o. Rm450 000 the actual calculation of stamp duty is before first time house buyer stamp duty exemption.

Rm9000 rm5000 rm4000 stamp duty to pay saving amount. However if you are looking to purchase a property that is valued from rm300 001 to rm1 000 000 from 01 january 2019 to 30 june 2019 the stamp duty exemption is only valid for properties purchased directly from developers only. With the generosity of the malaysian government and to increase the purchasing house for first time house buyer the government had implemented a stamp duty exemption started 1st january 2019 until 31st december 2020.

From 01 january 2019 to 31 december 2020 sub sales are included in the stamp duty exemption for first time buyers for up to rm300 000 in property values only.