First Time Home Buyer Stamp Duty Exemption Malaysia 2020

1 jul 19 31.

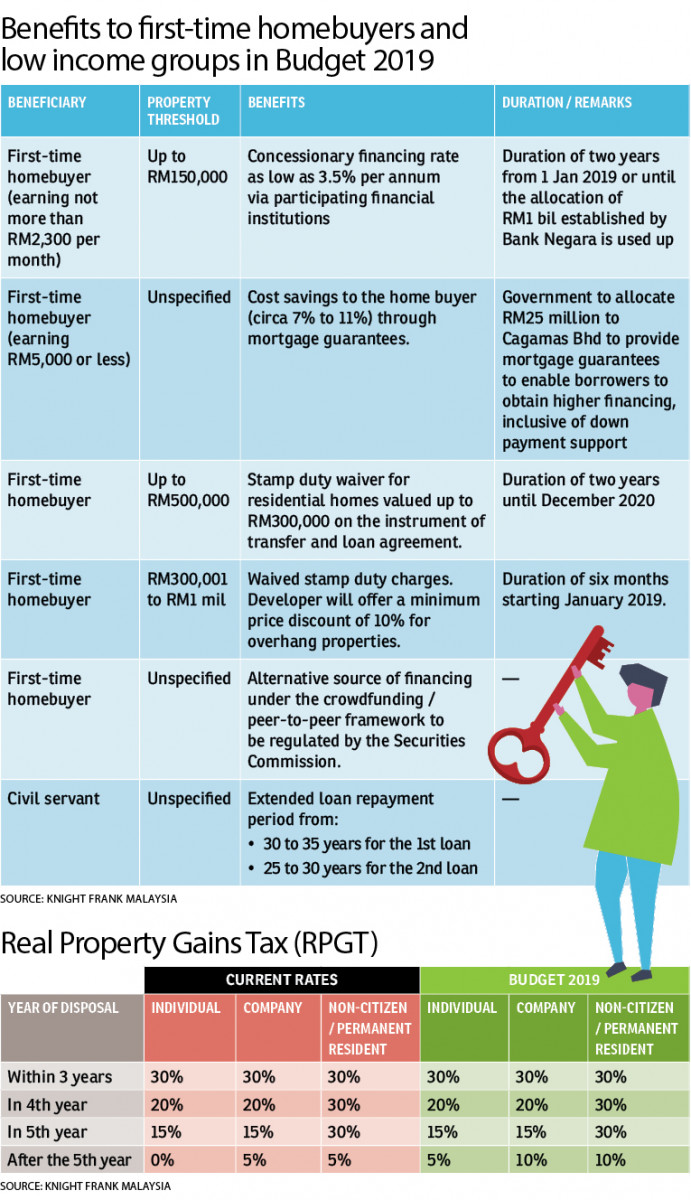

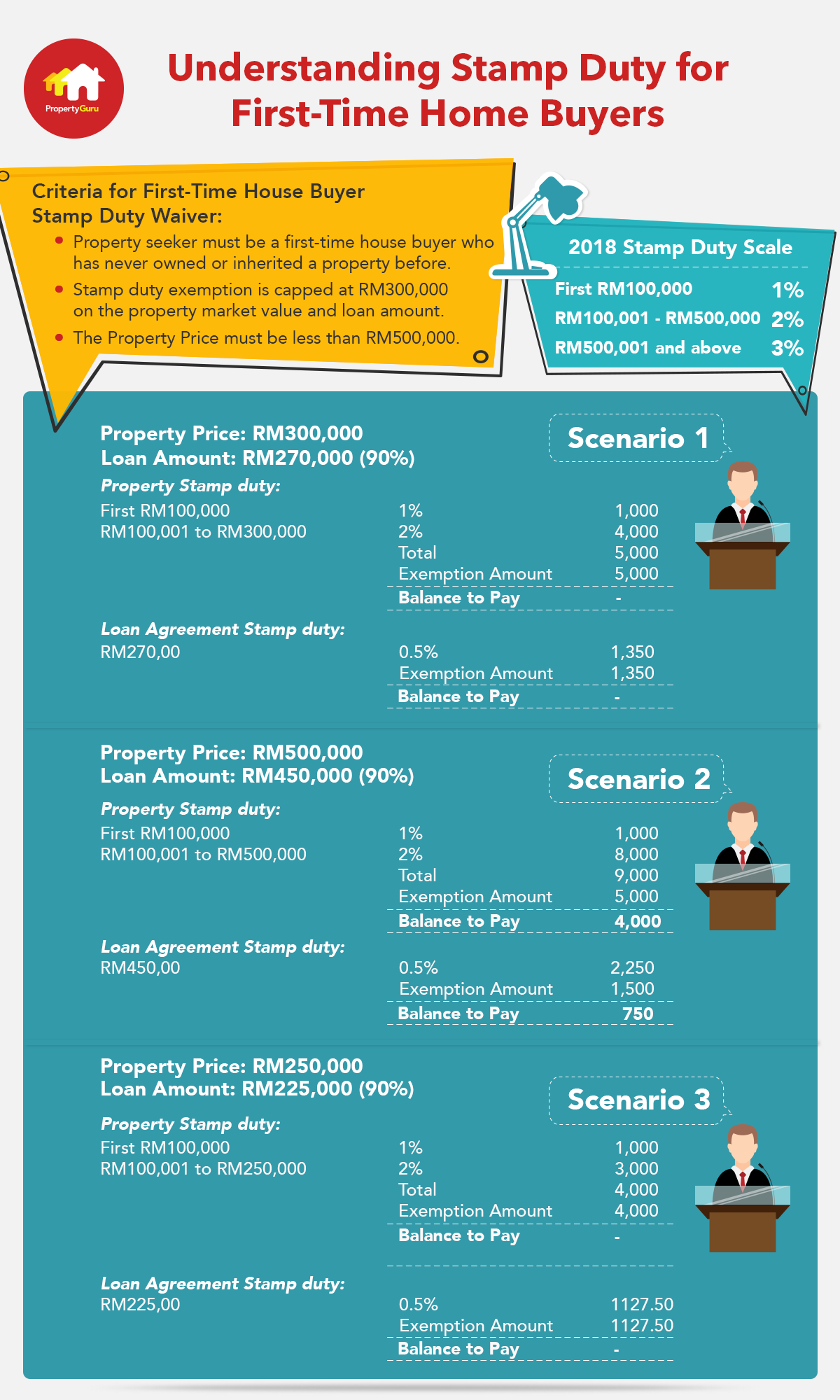

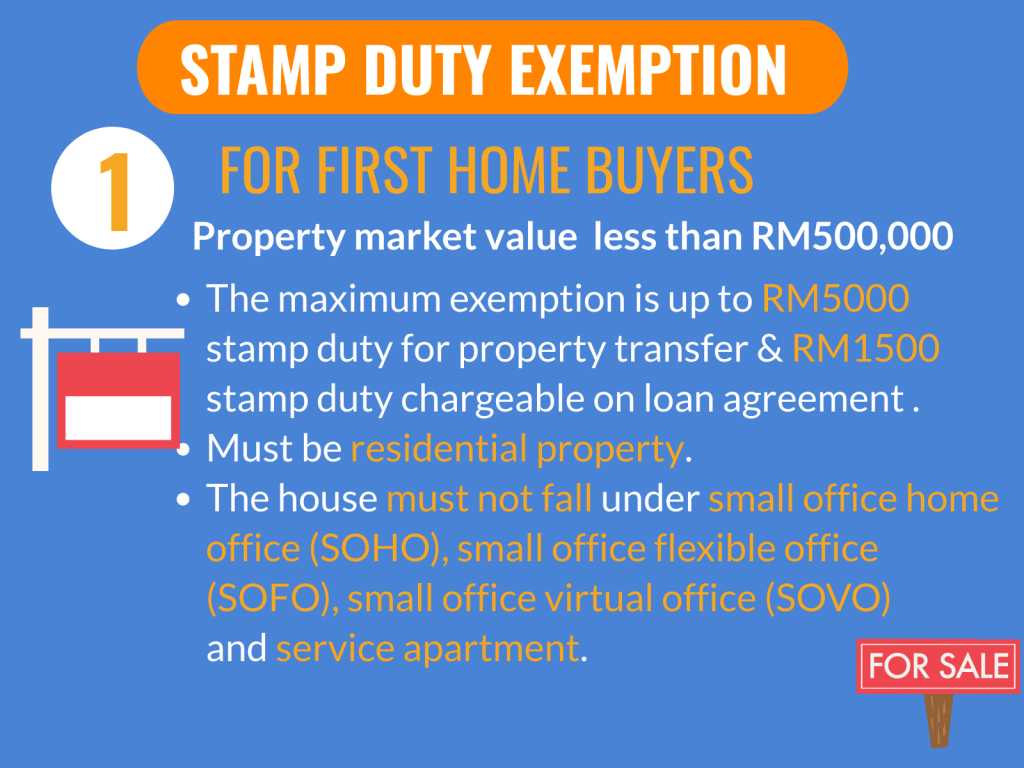

First time home buyer stamp duty exemption malaysia 2020. The hoc this time around carries the same set of benefits as previously notably. Stamp duty exemption on the instruments of transfer and loan agreement for the purchase of residential homes priced between rm300 000 to rm2 5 million subject to at least 10 discount provided by the developer. For purchases of between rm300 001 and rm500 000 a similar stamp duty waiver is applicable limited to only the first rm300 000 of the house price.

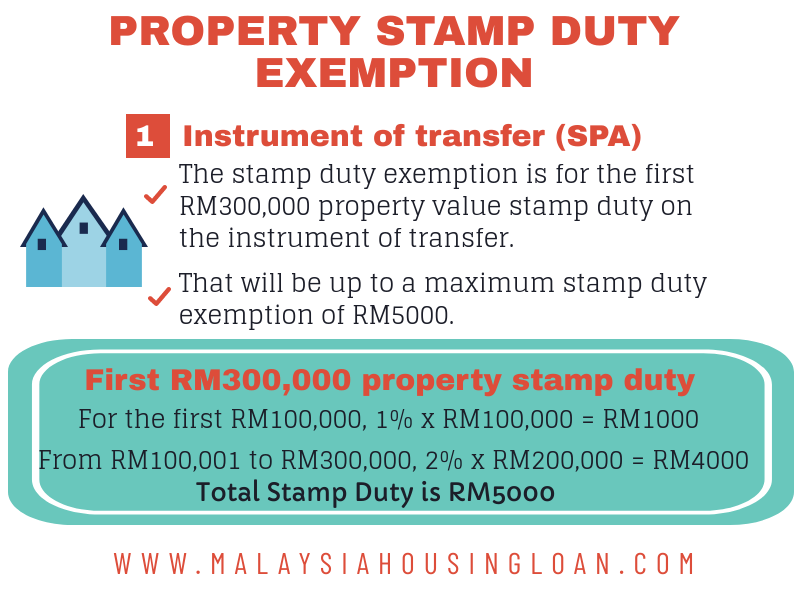

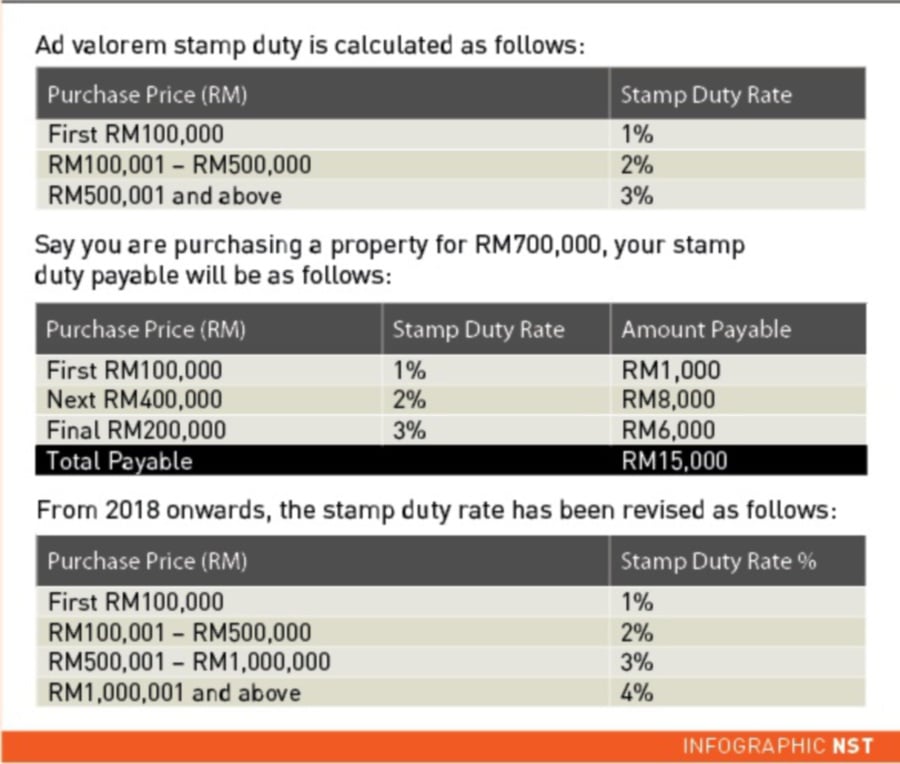

Rm9000 rm5000 rm4000 stamp duty to pay saving amount. Home loan for first time home buyers. First time homebuyers get stamp duty exemption on the memorandum of transfer and loan agreement for property purchases priced no more than rm300 000.

Compensation if your home has been acquired. After first time house buyer stamp duty exemption. What are the benefits of the home ownership campaign 2020.

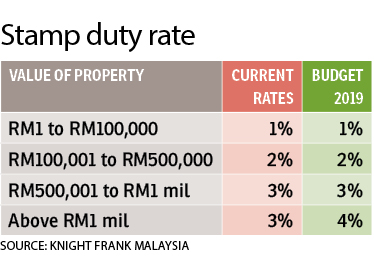

Rm300 001 to rm500 000 purchase price stamp duty exemption only applicable after 1st july 2019. The new stamp duty malaysia 2019 exemption for first time house buyer will be the same as the previous year stamp duty 2018 where for first time home buyers that purchasing residential properties priced up to rm500 000 stamp duty exempted up to rm300 000 on sale and purchase agreements as well as loan agreements for a period of two years until december 2020. 1 jan 19 31 dec 20 2 purchase 1 residential property a house condo unit an apartment a flat 3 malaysian citizen first time home buyer.

100 on the first rm300 000 and excess is subject to the prevailing rate of stamp duty the above exemption is applicable for sale and purchase agreement executed from 2019 to 31st december 2020 2020 stamp duty scale. Financial support for nsw first home buyers. Best home loan calculator in malaysia with legal fees.

Stamp duty calculation malaysia 2020 and stamp duty malaysia exemption stamp duty malaysia 2020 commonly asked questions. From 22 november 2017 first time buyers paying 300 000 or less for a residential property will pay no stamp duty land tax sdlt. The threshold for existing home purchases remains unchanged.

Full stamp duty exemption on loan agreement and transfer instrument 14a doa rm300 000 ppp rm500 000. Rm450 000 the actual calculation of stamp duty is before first time house buyer stamp duty exemption. You may be eligible to apply for an exemption or reduction of transfer duty charges under fhbas.

First home buyer assistance scheme fhbas the nsw government recently announced increased thresholds for purchases of new homes and vacant land to build a new home from 1 august 2020. First time buyers paying between 300 000 and 500 000 will. A grant of 25 000 to eligible owner occupiers.