Form B Income Tax Malaysia

Delete whichever is not relevant income tax no.

Form b income tax malaysia. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. Identification passport no. Be form income assessed under section 4 b 4 f of the income tax act 1967 ita 1967 and be completed by individual residents who have income other than business.

As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs and deductibles available. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. B 2018 year of assessment form cp4a pin.

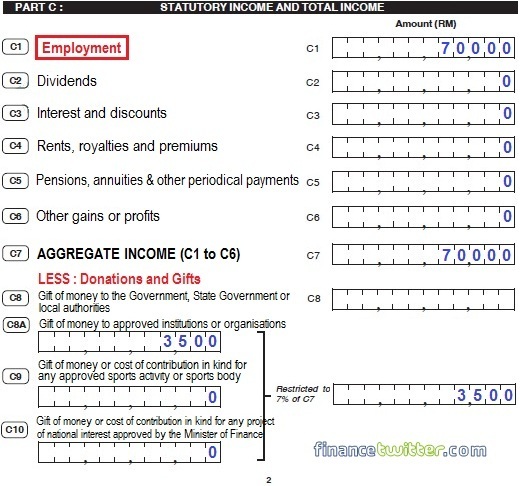

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes. Pada amnya stokc digunakan bagi tujuan tuntutan bayaran balik cukai jualan dan perkhidmatan cukai nilai tambah atau cukai barangan dan perkhidmatan sst vat dan gst yang dibayar di luar negara oleh individu syarikat atau badan orang di malaysia.

Remittance slip for payment of increase in tax subsection 109 2 109 b 2 109 d 3 109 e 4 109 f 2 or 109g 2 of the income tax act 1967 form cp147 pin 9 2014 this form can be downloaded and submitted to lembaga hasil dalam negeri malaysia. Once you ve logged in you will be shown a list of features available on e filing. Meanwhile for the b form resident individuals who carry on business the deadline is 15 july for e filing and 30 june for manual filing.

Untuk makluman stokc adalah pengesahan yang dikeluarkan oleh lhdnm ke atas status seseorang yang dikenakan cukai di malaysia. Here is a list of income tax forms and the income tax deadline 2019. Choose the right income tax form.

2018 lembaga hasil dalam negeri malaysia return form of a individual on business under section 77 of the income tax act 1967 this form is prescribed under section 152 of the income tax act 1967. Taxpayer is responsible to submit income tax return form itrf and make income tax payment yearly prior to due date. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing.