Hdfc Bank Sbi Home Loan Interest Rate 2020

Sbi vs hdfc ltd home loan compare interest rates 2020 16294 views hdfc ltd sbi.

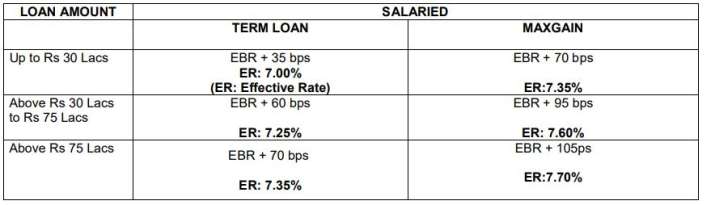

Hdfc bank sbi home loan interest rate 2020. Hdfc lowers lending rates by 10 bps. The home loan interest rates above are variable in nature and subject to change as per the movement in hdfc s rplr. Ebr 35 bps er.

Hdfc cuts home loan rates by 0 05. Effective rate ebr 70 bps. The bank is deemed as the largest mortgage lender in the country and offers a wide product range with low processing fees lowest interest rates no prepayment charges and without any hidden costs.

Up to rs 30 lacs. The new hdfc home loan interest rates will benefit all the new as well as existing hdfc home loan customers. Onwards is for women monsoon bonanza offer.

Union bank of india home loan interest rate at 6 70 is available for salaried women customers with cibil score above 700 applying for a loan up to 30 lakh. Through phone call. 1 crore and lastly additional 0 5 of interest concession of the loan is applied through sbi.

Home loan market in india is dominated by these two players state bank of india hdfc ltd. 30 lakh and less than rs. 75 lakhs and above.

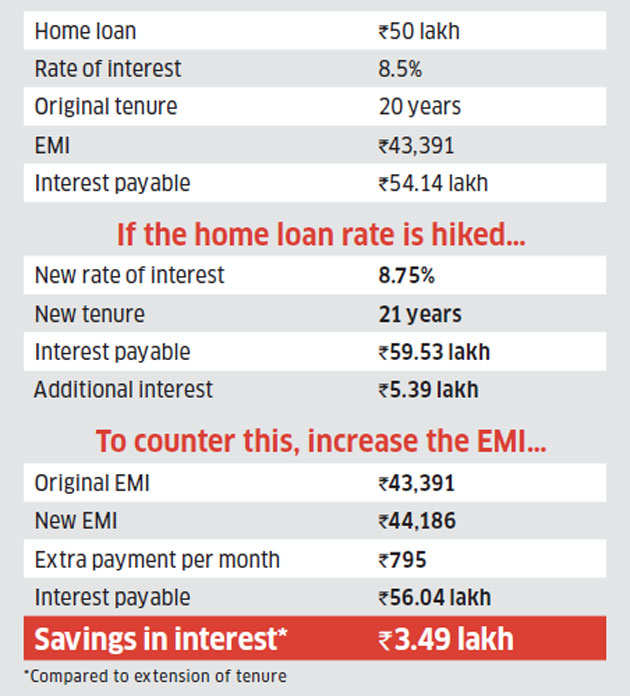

The existing home loan customers of hdfc can opt for interest rate conversion facility wherein the customers can ask the bank to reduce the applicable interest rate. The state bank of india sbi has announced special offers on home loans. Hdfc bank home loan details updated on 6th september 2020.

Floating interest card rates w e f 01 07 2020 a home loan interest card rate structure floating. 1 year to 30 years. The customer needs to pay a nominal conversion fee 0 50 1 75 of the principal outstanding.

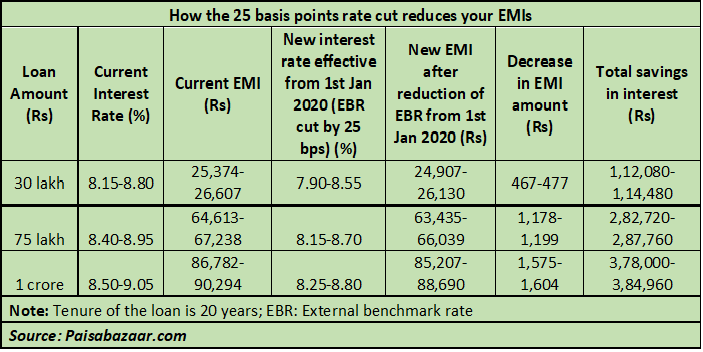

Loan amount salaried. This is a limited period offer and is subject to change the interest rate is available for customers who apply for loan on or before march 31 2018 and avail of their first disbursement on or before april 30 2018. Reduces its floating rate home loans by 0 05 with effect from 06 january 2020.

The above home loan interest rates emi is applicable for loans under the adjustable rate home loan scheme of housing development finance corporation limited hdfc and is subject to change at the time of disbursement. The new rates will now range from 8 20 to 9 per annum. State bank of india never ask for your user id password pin no.

The lender will offer borrowers applying for sbi home loans three benefits nil processing fee 0 10 interest concession for borrowers with a higher cibil score for loans above rs. The rates above are variable in nature and linked to hdfc s rplr and shall fluctuate according to the movement in the same.